Payment Voucher in Tally Prime

Payment Voucher is used to record all types of payments made by a business, whether in cash, by cheque, or through bank transfers. It helps in tracking expenses, payments to suppliers, loan repayments, salary disbursements, and other financial outflows.

Recording Payment Voucher:

You can use a Payment Voucher to record cash and bank payments in either Single Entry or Double Entry mode.

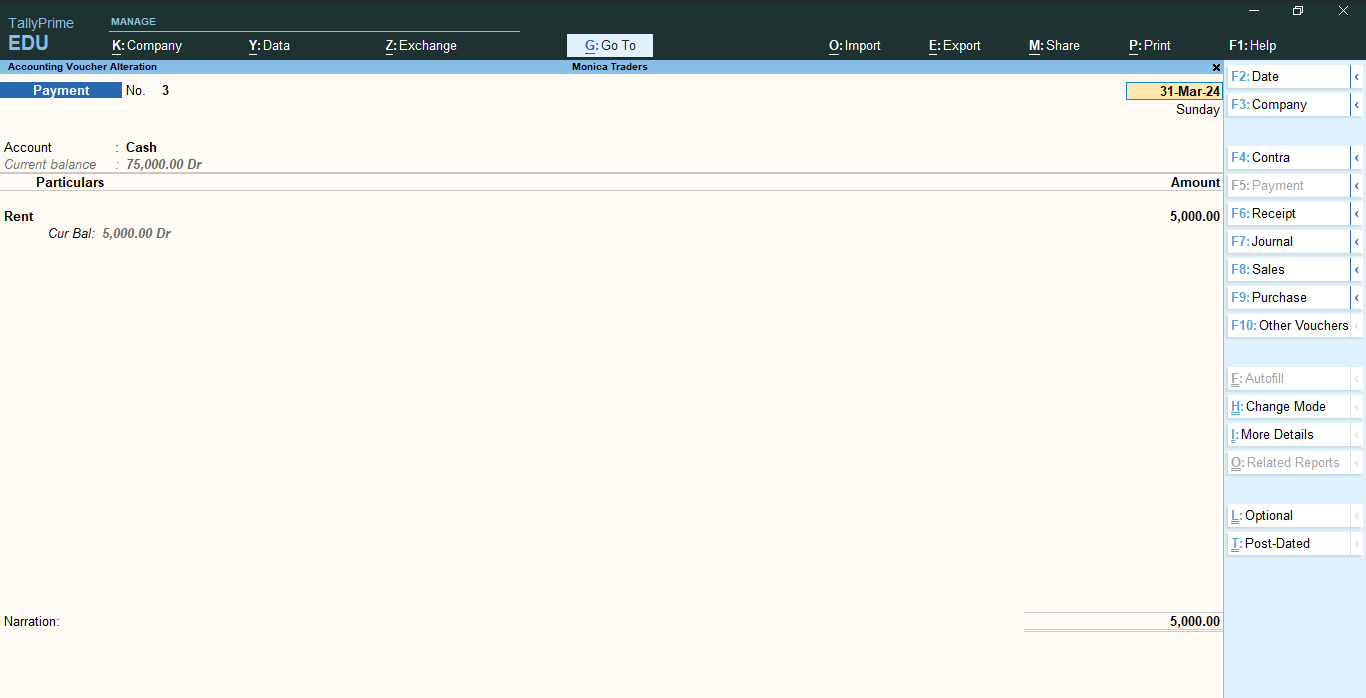

Payments in Single Entry Mode

In Single Entry Mode, you enter transactions in a simple, user-friendly way without needing to specify debit and credit separately. This mode is useful when making payments to suppliers, employees, or for business expenses without needing to manually enter both debit and credit accounts.

Example: If a business pays ₹5,000 for office rent by cash.

- In "Gateway of Tally" Window => click "Vouchers" => press F5 (Payment).

- Press Ctrl+H (Change Mode) => select Single Entry.

- In Account field, select the Cash ledger.

- Under Particulars, select the Rent ledger, and enter the amount in Amount column.

- If the Rent Ledger is not available in the ledger list, you can create it instantly using the Alt + C shortcut and enter the amount in Amount column.

- Press Enter or click on "Yes" in the Accept Screen

- Alternatively, Press Ctrl + A to save the voucher.

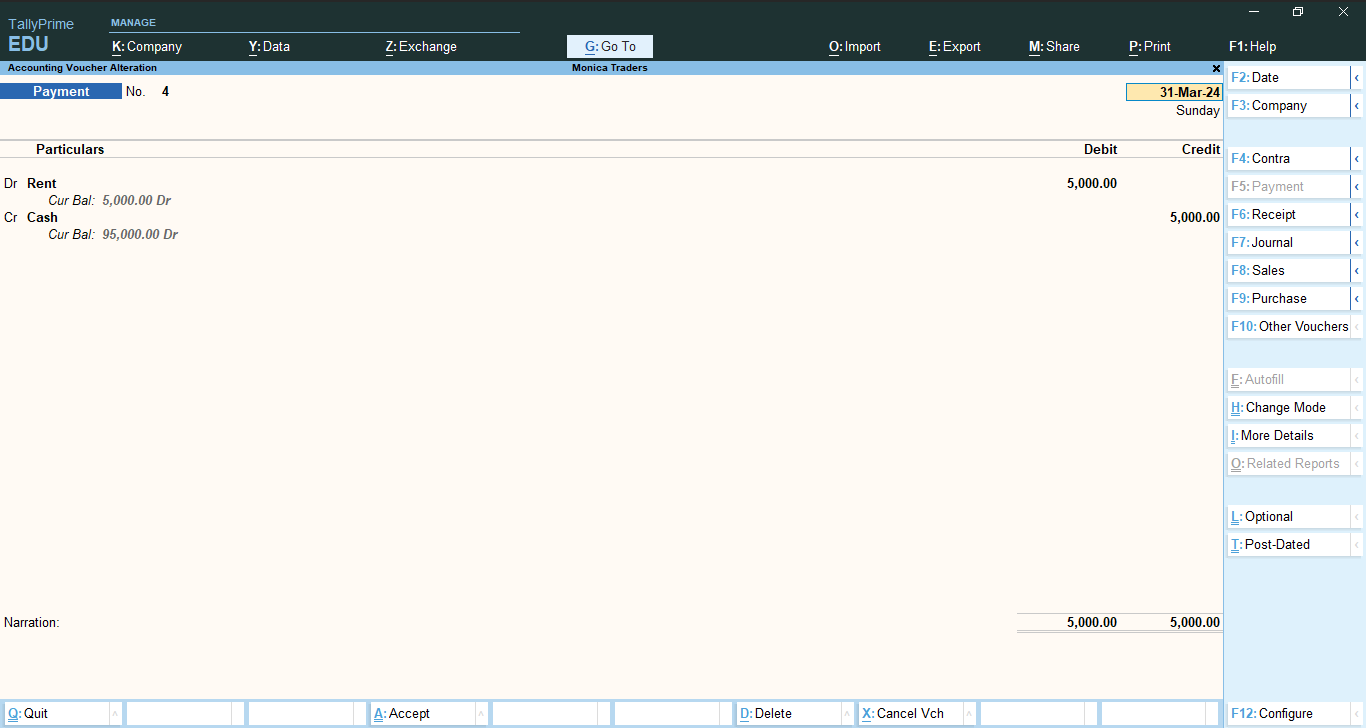

Payments in Double Entry Mode

Double Entry Mode refers to the accounting system where every transaction is recorded in at least two accounts: one as a debit and the other as a credit, ensuring that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

- Debit Account (Dr) => The account being debited (e.g., Expenses, Purchases, Supplier Account).

- Credit Account (Cr) => The cash or bank account from which the payment is made.

Example: If a business pays ₹5,000 for office rent by cash.

| Particulars |

Debit (Dr) |

Credit (Cr) |

| Rent A/c (Expense) |

₹5,000 |

|

| Cash A/c |

|

₹5,000 |

- In "Gateway of Tally" Window => click "Vouchers" => press F5 (Payment).

- Press Ctrl+H (Change Mode) => select Double Entry.

- Dr: Debit the Expense ledger and enter the amount in Debit column.

- Cr: Credit the Cash ledger and enter the amount in Credit column.

- If the Rent Ledger is not available in the ledger list, you can create it instantly using the Alt + C shortcut and enter the amount in Amount column.

- Press Enter or click on "Yes" in the Accept Screen

- Alternatively, Press Ctrl + A to save the voucher.

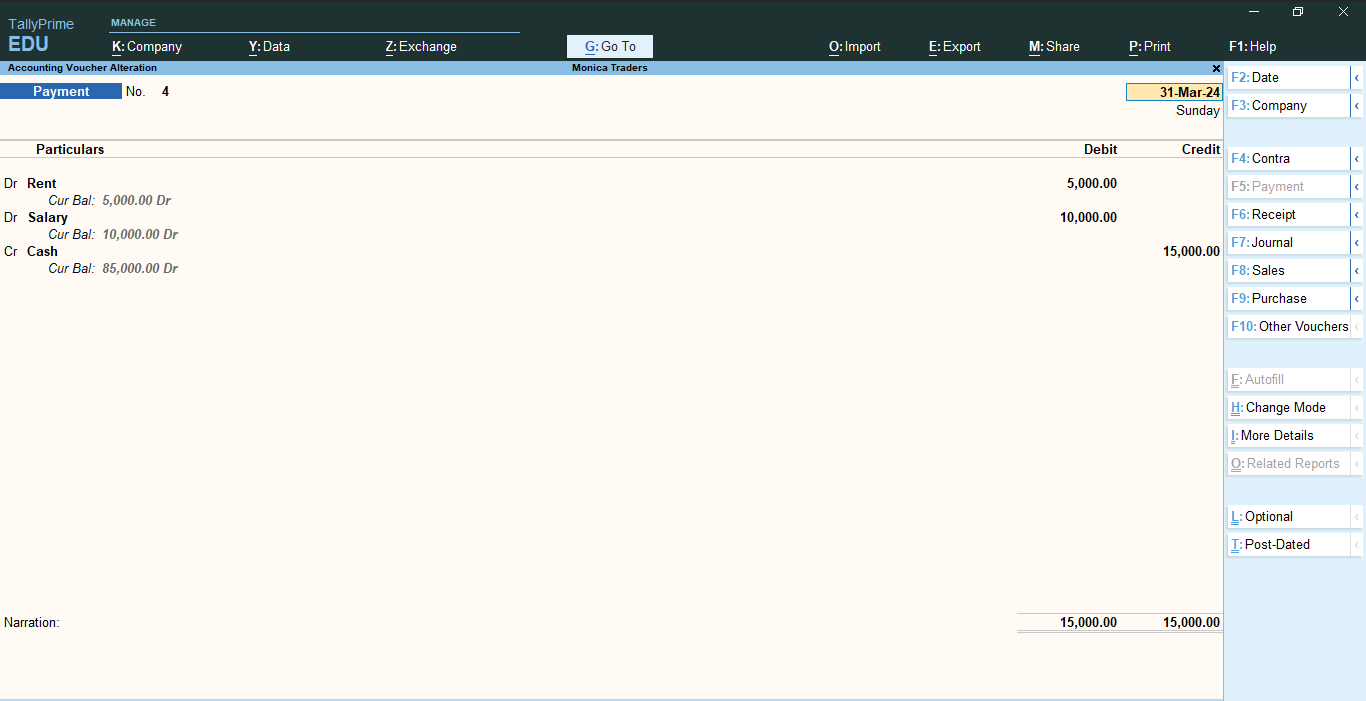

Payments in Double Entry Mode with Multiple Ledgers

Example: If a business pays ₹5,000 for office rent and ₹10,000 for salary by cash.

| Particulars |

Debit (Dr) |

Credit (Cr) |

| Rent A/c (Expense) |

₹5,000 |

|

| Salary A/c (Expense) |

₹10,000 |

|

| Cash A/c |

|

₹15,000 |

- In "Gateway of Tally" Window => click "Vouchers" => press F5 (Payment).

- Press Ctrl+H (Change Mode) => select Double Entry.

- Dr: Debit the Rent ledger and enter the amount in Debit column.

- Dr: Debit the Salary ledger and enter the amount in Debit column.

- Cr: Credit the Cash ledger and enter the amount in Credit column.

- If the Rent and Salary Ledger is not available in the ledger list, you can create it instantly using the Alt + C shortcut and enter the amount in Amount column.

- Press Enter or click on "Yes" in the Accept Screen

- Alternatively, Press Ctrl + A to save the voucher.

Payments Entry with Examples

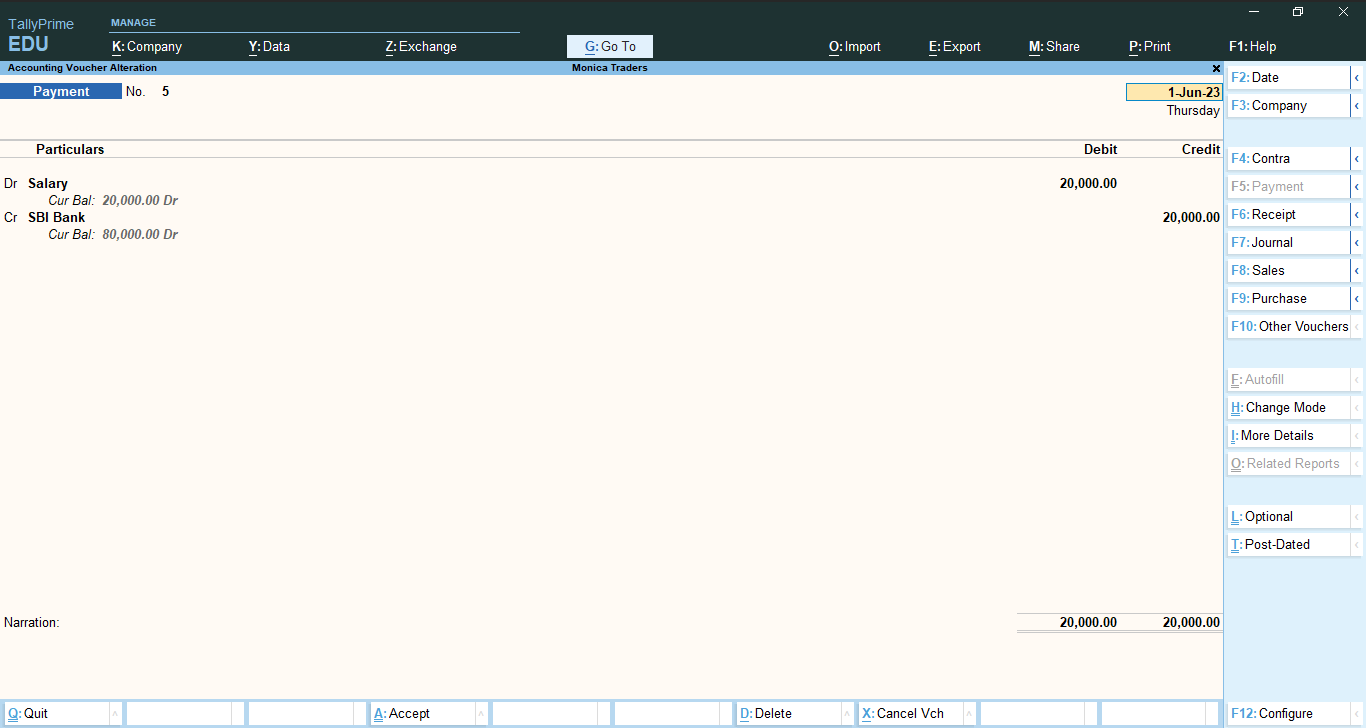

Example 1 : A company pays ₹20,000 as salary to an employee via bank transfer.

| Particulars |

Debit (Dr) |

Credit (Cr) |

| Salary A/c (Expense) |

₹20,000 |

|

| SBI Bank A/c (Bank Account) |

|

₹20,000 |

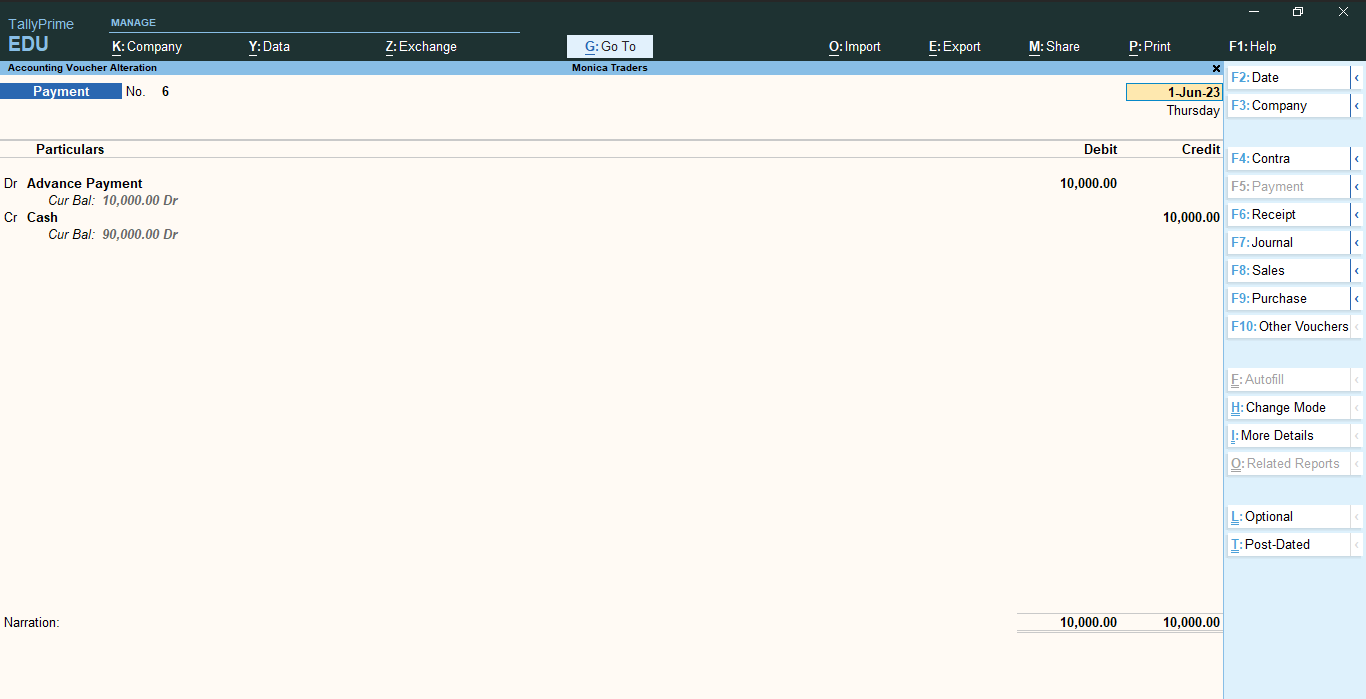

Example 2 : A company gives an advance of ₹10,000 to ABC Traders for a future order.

Example 2 : A company gives an advance of ₹10,000 to ABC Traders for a future order.

| Particulars |

Debit (Dr) |

Credit (Cr) |

| Advance Payment (Current Asset) |

₹10,000 |

|

| Cash A/c |

|

₹10,000 |

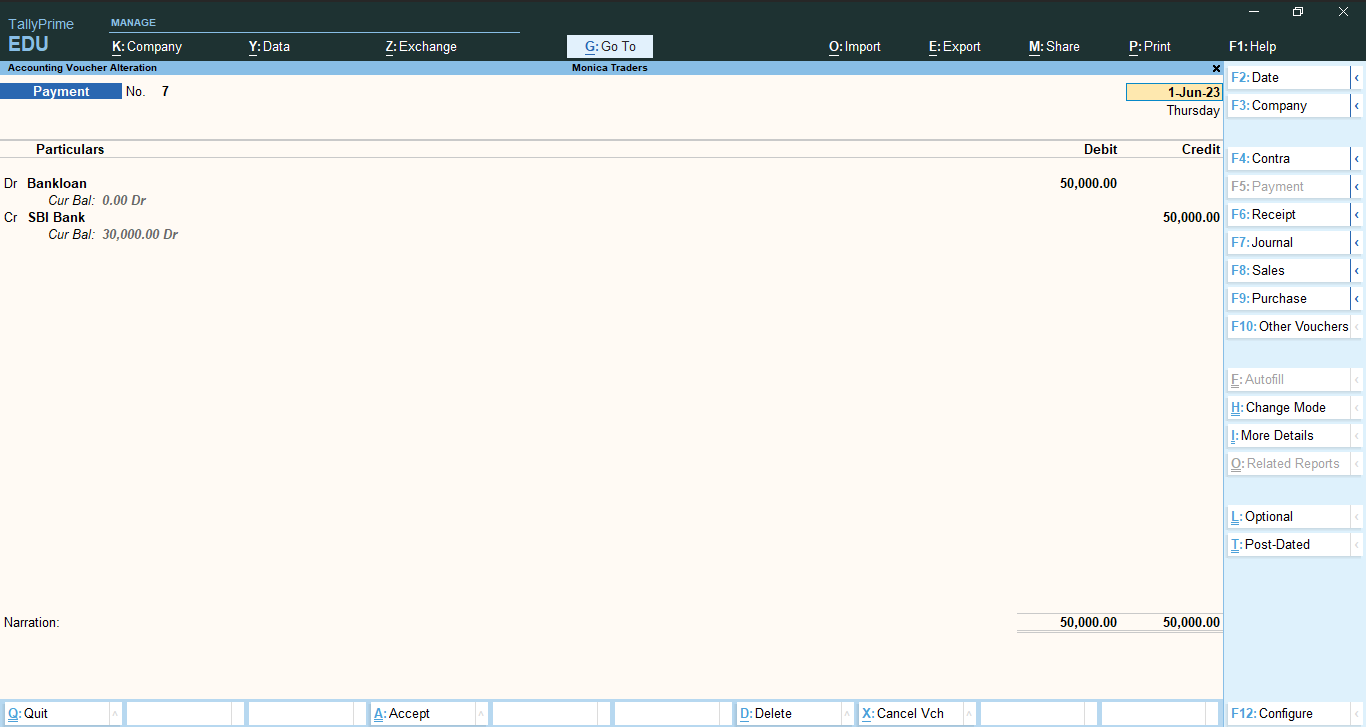

Example 3 : A company repays ₹50,000 towards a loan from SBI Bank.

Example 3 : A company repays ₹50,000 towards a loan from SBI Bank.

| Particulars |

Debit (Dr) |

Credit (Cr) |

| Bank Loan A/c (Loan Liability) |

₹50,000 |

|

| SBI Bank A/c (Bank Account) |

|

₹50,000 |

Example 4 : A company making a payment of ₹20,000 to its creditor XYZ Traders via HDFC Bank for goods purchased earlier.

Example 4 : A company making a payment of ₹20,000 to its creditor XYZ Traders via HDFC Bank for goods purchased earlier.

| Particulars |

Debit (Dr) |

Credit (Cr) |

| XYZ Traders (Sundry Creditors) |

₹20,000 |

|

| HDFC Bank A/c (Bank Account) |

|

₹20,000 |